NBAD Bank Balance

The National Bank of Abu Dhabi (NBAD) is one of the largest banks in Abu Dhabi and is considered as one of the dominant financial institutions in the United Arab Emirates. With time, it expanded its services and network globally and provided a wide range of banking and financial products to individuals, companies, and institutions. The bank also offers you various financial services like retail banking, corporate banking, investment banking, asset management, private banking, and etc. It had the largest capitalization among all the banks in the United Arab Emirates. The bank’s international networks span over 17 countries in five continents from the Far East to Americas.

NBAD was established in 1968 and was the first bank in Abu Dhabi. In December 2013, 70.2% shares of the bank were owned by ADIC and the remaining 21.9% was owned by parties including the Government, corporate and private institutions. In the year 2016, the board directors of the National Bank of Abu Dhabi and First Gulf Banks (FGB) decided to merge their two banks. The main aim of NBAD Bank Balance Check is to fulfill the needs of its customers and maintain a strong presence in both local and international markets.

Cards offered by NBAD

There are various prepaid cards that are offered by the National Bank of Abu Dhabi to fulfill the customers demands and needs. These prepaid cards allow the user to load funds onto the card in advance and then the user can use it for purchasing, online transactions, and cash withdrawal up to the available balance. Below are some prepaid cards that are offered by the NBAD:

- Ratibi Prepaid Card

- Blue e-Dirham Prepaid Card

- Red e-Dirham Prepaid Card

- Green e-Dirham Prepaid Card

- Silver e-Dirham Prepaid Card

- Gold e-Dirham Prepaid Card

These are the different varieties of cards that are offered by the NBAD. The Green, Blue, Red, and Golden cards are made in collaboration with the UAE Treasury. It is nor mandatory to have a bank account in this bank when applying for these cards.

Features and Benefits of Prepaid Cards

There are various benefits and offers for those customers who are using prepaid cards. The features of prepaid cards also vary depending upon the type of the card. So, now look at some of the special features and benefits of prepaid cards:

- You can use the prepaid cards to pay for any good and service and customers does not need to worry about the hassles of making cash transactions

- These cards are also associated with major payment networks like Visa or Mastercard which allows the user for worldwide transactions

- The user will always get an extra cash for urgent purchases and transactions until the card expires

- This card also helps the user to pay the bills through a customer’s mobile phone

- It is also used as travel cards to load currency when the user is traveling abroad

- To avoid the overspending of money, the user can track his income and expenses effectively

- It also allows you to identify any unauthorized or fraud transactions

- It provides more security and reduces the risk of exposing sensitive financial information during transactions

- It is also called as gift card and allow the recipients to choose the items they want from participating merchants

These are some of the features and benefits that are provided to the user of the NBAD prepaid cards. If you have a prepaid card, then you can also take advantage of these benefits.

Various methods to check NBAD Balance

Online Method:

You can check your NBAD balance through an online method. Follow the steps below to check your NBAD balance through online:

- First you have to visit the NBAD official website and access the Internet Banking Portal

- Then fill up your username and password to log in to your account

- After logging in to your account, you will see your account overview and dashboard. Here you will be able to see a summary of your accounts including the available balance

- After that choose the specific account that you want to check, and it will show the detailed information for that account including the current balance of the account

- You will be also able to see the recent transactions and account activity

- Don’t forget to log out from your Internet banking account to ensure the security of your account

Through Mobile Applications:

You can also check your NBAD balance through the Mobile Applications. If you are unaware of this method, then continue reading this article. Following steps will help you to check the NBAD balance:

- To check the balance, you must have the official NBAD or FAB mobile banking app installed on your mobile phone

- If not installed, you can download the application from the google play store or apple play store

- Open the application, then enter your details like username and password to log in to your account

- After logging in, you will directly reach the homescreen of the application. Here, you will be able to see the summary of your accounts including the available balances

- In case of multiple accounts, choose the account you want to check the balance

- After clicking on it, the app will display all the details in the screen including the current balance and recent transactions

- After checking your balance, don’t forget to log out your bank account for security purposes

Customer care:

You can also contact customer care to check your NBAD balance. Here are some tips on how to contact the customer care to check the balance:

- Dial the customer care helpline number from your mobile phone. If you don’t have a customer care number, then you can collect it from their official website or else from the back of your debit or credit card.

- When you call on the customer care number, a representative will answer your call and will ask you about your problems.

- First you have to verify your identity for security purposes and to access your account.

- The representative will ask you for some details like your account number, full name, date of birth, and other information.

- Then you have to tell the customer card that you want to check your account balance. They will access your account details on their system and will provide information about your current balance.

- When the representative provides the information, listen to them carefully to ensure that you get the correct account balance or not.

- Besides this, you can also ask any other account-related inquiries to the representative.

- Once you get all your answers, thank the representative for their assistance and end the call.

Through all these 3 methods, you can check the current account balance of your NBAD account. Besides these, you can also ask other queries to the customer care representative. So, feel free to talk with the representative and tell them your problems or doubts regarding the account.

NBAD Salary check

If you have an NBAD account, then you can check your salary electronically by using the below steps:

- Go to the NBAD’s official website.

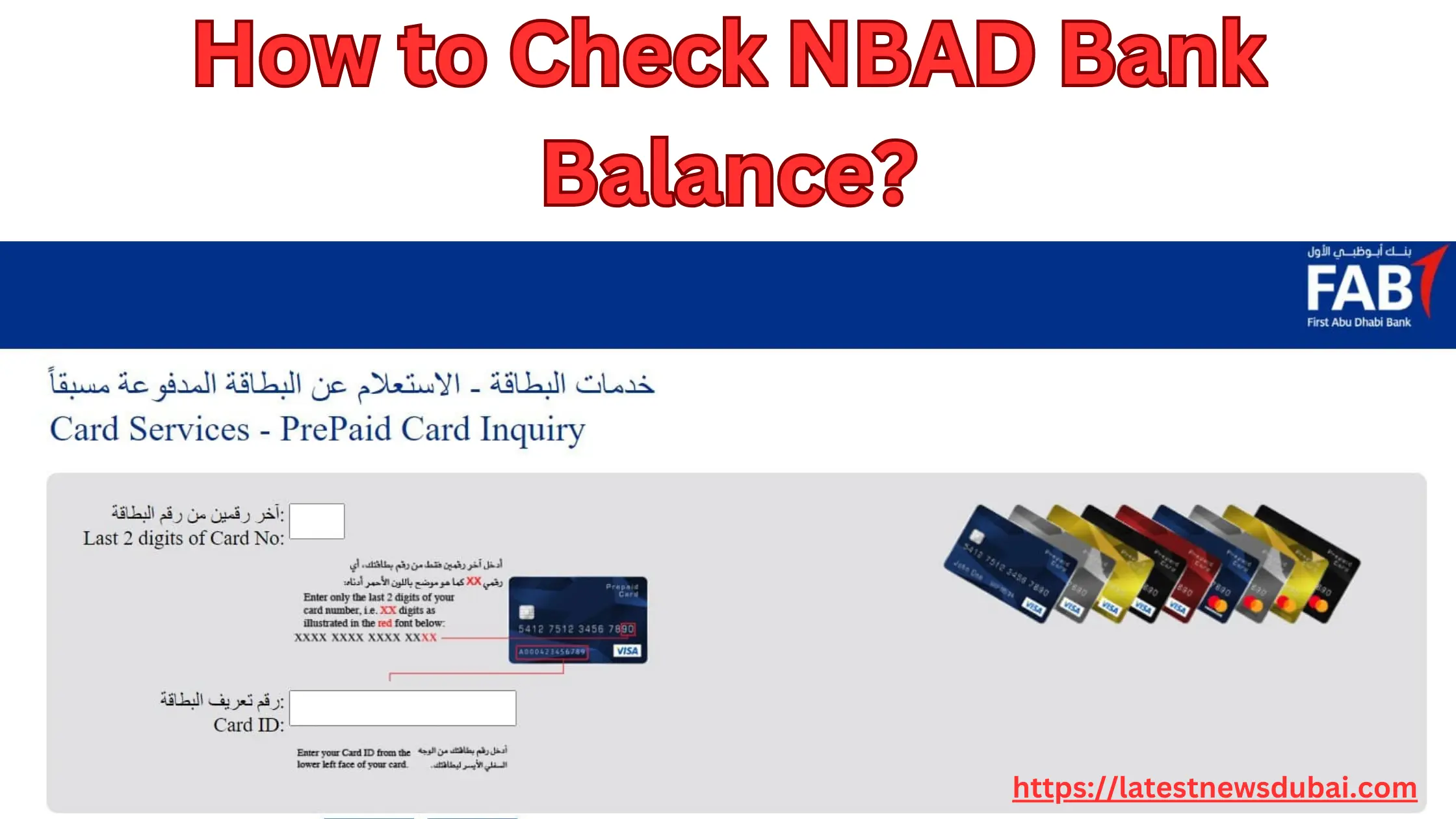

- After that, the prepaid Card Inquiry page for card services will appear on your mobile or laptop screen.

- Enter the last two digits of your card.

- After that, enter your Card ID and click on the GO button.

- At last, you will be able to see your account details on your display screen.

Some Important tips for Account Security and Privacy

In this digital era, you will find many frauds who are asking some details of your bank account. Be aware of these frauds and protect your account and personal information. Below are some few tips to protect your bank account from the frauds:

Create Strong Passwords: Always use a strong password to protect your account from frauds. An easy password will help the fraudsters to guess it. A strong password is a mix of uppercase, lowercase, letters, numbers, and special characters. So, avoid using easy and guessable passwords like your names or birth dates.

Multi-Factor Authentication: The Multi Factor Authentication provides additional security by asking you to provide multiple forms of identification such as password, OTP to access your accounts which makes it impossible for the fraudsters to hack your bank account.

Protect Personal Information: If you get a call from an unknown number who is asking you about your personal information related to your accounts. Then avoid sharing your sensitive information such as account numbers, passwords, or OTP.

Inform your Bank: In case you are changing your mobile number, then don’t forget to update your new mobile number with your bank account.

Certainly, to efficiently manage your finances with a Zintego itemized bill and check your National Bank of Abu Dhabi (NBAD) bank balance.

Conclusion

Are you guys unaware of how to check the current balance of your NBAD bank account? No need to worry, we are here to solve your problem. Here you can read about all the methods to check the account balance. I hope this article might helped you knowing about how to check balance.

Also Check out: FAB Card Balance Online